🛒 The problem with eCommerce

It turns out it's pretty easy to lose money. Here's what brands can do.

I’ve been amazed at how quickly the stores in my neighborhood have facilitated a digitally-enabled experience in response to COVID restrictions. Local restaurants are using Instagram to push out menus and posting Venmo codes in their windows to facilitate payment. Local boutiques are hosting livestream events to show off summer styles. All of this ingenuity is amazing, but made me wonder how the numbers will stack up for brick-and-mortar based businesses over the long run as they build out their own eCommerce operations.

Impulse shopping is a real problem for shoppers, but great for brands. Image via Frankie Cordoba for Unsplash.

eCommerce is accelerating in the pandemic era

According to Retail Dive, eCommerce captured 19% of overall retail sales, up from 12% on average the past two years, according to Wells Fargo Economics Group, led by Senior Economist Tim Quinlan. A Mastercard SpendingPulse report found that e-commerce sales increased by 92.7% in May.

Experts speculate that this shift may be permanent. Many customers are trying online shopping for the first time. Others are experimenting with purchasing habitual categories online (e.g. grocery delivery, alcohol delivery, prescriptions) and after establishing these patterns, they will be sticky.

The brick-and-mortar perspective

I spent my early career in traditional (largely brick-and-mortar) retail where eCommerce initiatives were met with ambivalence. While leadership at my former companies appreciated how the online channel could reach new customers, extend CLV for loyal fans of the brand, and serve as a powerful new channel to complement in-store, they also worried about the margin-diluting aspects of selling online.

Today, brands face no choice but to develop their eCommerce channel, and to do it fast. But the reality is that there are several dynamics that threaten profitability. I’ll highlight some of these, and how brands can innovate to mitigate these challenges.

Lower basket sizes

Twitter is full of memes about people walking into Target for one thing and leaving with a million things they don’t need.

It’s very rare that I browse Target’s online site and impulse-shop in the same way. The data supports this: a 2019 First Insight Report found that 71% of all shoppers surveyed spent $50 or more when shopping in-store. This compares to only 54% of respondents spending more than $50 when shopping online. This difference in customer behavior is a costly one for brands.

Discovery challenges

Despite advances in the online shopping experience, most online shopping remains need-oriented (Amazon represents 38% of total eCommerce sales in the U.S., and leans heavily toward transactions that start in the search bar).

While social media has created opportunities for purchase inspiration similar to a beautifully-merchandised department store window, we’re still in the early days of Instagram Shops. Replicating discovery in the way that people organically find things in-store has so far proved elusive, resulting in fewer opportunities to grow transaction size.

More separate transactions

Online shoppers tend to transact across a larger number of small transactions. Rather than going to the store once and stocking up, I’ll go online and buy laundry detergent, a pair of socks, and dog food in three transactions as the need arises (welcome to my glamorous life). This results in three separate shipments, and three corresponding orders that need to be processed. Bad for margins!

Rising fulfillment costs

Costs associated with fulfilling an online order include picking, packing, and shipping. And the bad news is that most of these costs are increasing for retailers.

Higher customer expectations

With Shopify’s new Shop app, I can see exactly where my packages are at any moment of the day. With Amazon, I can receive an order in a few hours. It’s very rare that I will pay for shipping. Across the board, customers expect quick, seamless, and free order fulfillment. The National Retail Federation found that that 75% of consumers surveyed expect delivery to be free even on orders under $50, up from 68% in 2019.

Amazon is largely responsible for this shift. But while many retailers rely on third-parties to fulfill orders, Amazon is building its own network enabling lower costs. Rakuten Intelligence reports that Amazon is delivering as much as 45% of their own orders (versus 8% in 2016).

Rates are increasing

As a DTC founder, I’ve already seen two rate increases from carriers like USPS and UPS, and experts predict costs will continue to rise. As eCommerce grows as a share of total sales, there will be more pressure on the infrastructure allowing these businesses to operate. We’re already started to observe delays in USPS processing times as the organization is overwhelmed with the sheer volume of shipments.

Costly and increasingly-prevalent returns

Raise your hand if you’ve ordered more than one size in an item, knowing that you’ll end up returning the one the doesn’t fit (I won’t tell anyone). Don’t be too embarrassed. I’ve done this, and so have 37% of Americans.

According to Vogue Business, eCommerce return rates have spiked 95% in the past five years. On average, this means that retailers lose a third of their revenue to returns, says RSR Research retail analyst Paula Rosenblum. This loss is much more significant in the online world, where trying on the products is impossible. Social pressure in-store also prevents us from purchasing multiple sizes and variations in the same way we do online.

For fashion brands especially, the problem is dire:

California e-tailer Revolve did $499 million in sales last year but spent $531 million on returns, after accounting for processing costs and lost sales. The number does not account for the retailer also covering the shipping costs of returns. Revolve declined to comment on whether it’s working to resolve this discrepancy.

About 10% of returns can’t be resold, and are donated or incinerated. Costs continue to accrue as these returns are processed, stored, and transported to their final destination.

Not only do brands need to pay for return shipping, they also need to process the return. When I receive a return for my startup, I look over the garment for signs of wear, retag it if necessary, and steam it before putting it in a poly bag and restocking it—very time-consuming!

Counterpoint: Stores are expensive, too!

Ok…we’ve established that eCommerce can be costly, but what about all of the costs associated with operating brick-and-mortar retail? Leases, build-outs, fixtures, staffing…the costs are significant.

My goal with this article isn’t to pit stores and online against each other. Brands obviously need both channels. Yet retailers reported a 25% erosion in earnings related to increased eCommerce penetration and the investments that went along with it, according to a 2017 study. Even when consumer confidence was healthy, retailers’ position was weakening. As eCommerce penetration accelerates, brands must be smart about mitigating the challenges that online presents.

What brands can do about costly eCommerce

There are limits to how much a brand can negotiate with USPS on rates. But there is ample opportunity to improve discoverability, grow transaction size, and reduce returns in ways that augment the customer experience.

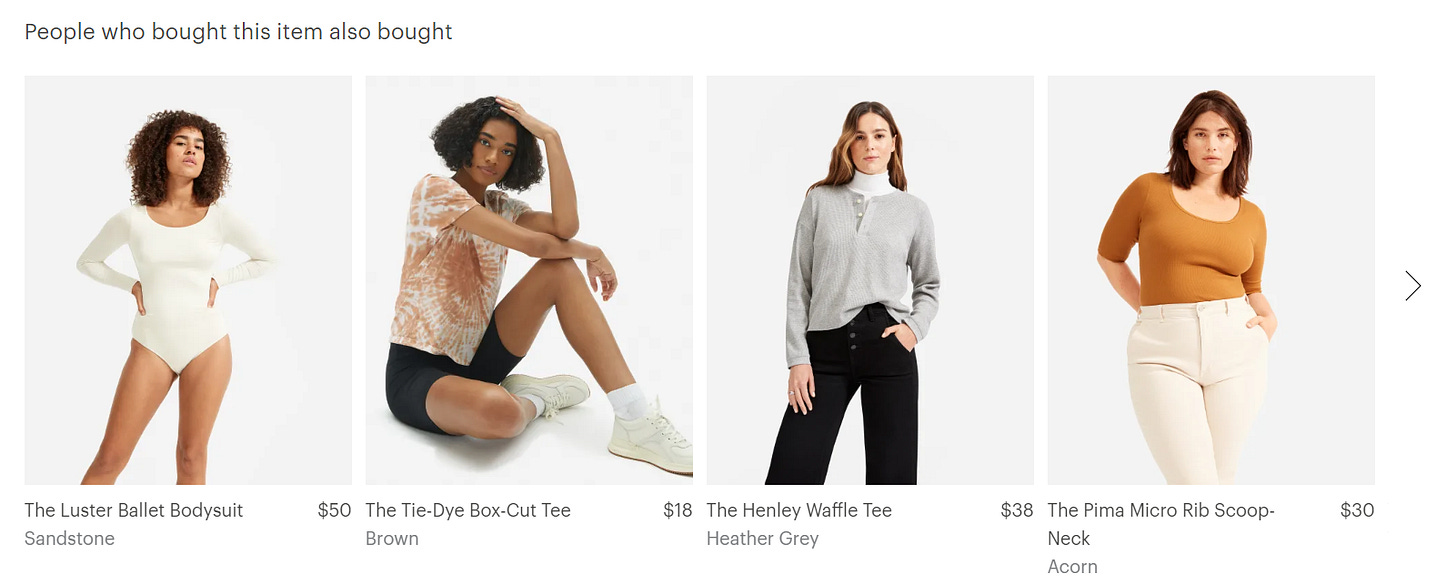

Relevant product suggestions

The goal in providing product suggestions is to nudge customers to increase transaction size by adding additional items to their order. Providing irrelevant suggestions, though, can be very annoying.

I recently bought some toys for my dog on Amazon and the next day received an email with the subject “Amazon recommends…” What did they recommend? Several near-identical toys to the ones I just ordered 🙄. This type of product suggestion is useless. Suggestions for other dog-related products—a dog bed, leash, etc. would be more likely to convert.

When implementing this strategy for your brand, dive into the data to understand what products make sense to recommend. There are tools available that automate this process and personalize the recommended product feed for each visitor. For small brands, past purchase data, insights from store associates, and an understanding of your core customer segments is a good place to start.

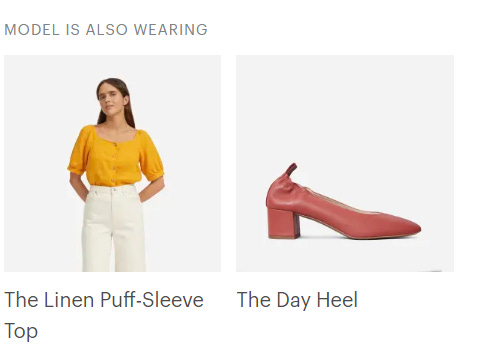

Product suggestions don’t only live on your site. They can also be leveraged throughout the customer journey. If a customer provides her email on-site, the brand should send an email with best-sellers, or better yet, a custom feed of items based on her browsing patterns. Post-purchase, the brand can share complementary items to the ones she purchased. Insights around items that are frequently purchased together can also inform creation of social assets.

On the site: Everlane does a good job showcasing relevant products. They have page sections for “similar items” and “how to complete the outfit” that have distinct goals and are both easily shoppable.

Missed opportunity: I bought some jogger shorts from Outdoor Voices. The brand offers a sports bra in a matching color/style. When writing this article, I went to see whether they sent any emails showcasing the matching piece. While I’ve received several product emails from them since I placed my order last month, none feature this relevant item that would help me complete my look. Matching sets are a trendy look for summer, and this would be easy to implement.

One more thought: My post last week on how brands are building niche marketplaces fits in with this concept. It’s yet another way brands are attempting to grow the basket by connecting site visitors with other items they may like during the same visit.

BOPIS & BORIS (fun acronyms!)

BOPIS (buy online, pickup in-store) and BORIS (buy online, return in-store) provide your customer with a chance to interact with your brand in a transaction that could otherwise be fully online. BOPIS is growing in popularity—70% of customers have used it more than once, and 37% more BOPIS orders were placed in 2019 vs. 2018.

During the pandemic, the opportunity created by an in-person interaction is even more valuable than usual. Many of us are stuck at home and are still fairly isolated. Maybe it’s just the extrovert in me talking, but getting advice from an associate at my local craft store about my knitting project is honestly really refreshing.

It’s also good for sales. According to one study, 69% of customers end up buying additional items when they come into the store to pick up or return a purchase.

An additional advantage to BOPIS is that it helps companies save on delivery costs. While there are staffing costs associated with executing BOPIS and BORIS at a large scale, many stores can support a modest volume of these transactions without significantly altering staffing.

Restaurants, which are still closed in NYC due to the pandemic, have been really creative about offering online/in-person hybrid solutions. A favorite of mine? Cafe Paulette in my neighborhood launched a build-your-own-picnic portal featuring local cheeses and wines.

Virtual consultations and styling sessions

Pre-pandemic, an emerging omnichannel strategy for brands was offering appointments. Saas platform JRNI finds that appointment-scheduling can drive basket size growth of 2x-3x. Appointment-based shopping recalls the white-glove service that was a marker of original department stores in the early 1900s—it’s an opportunity to inject the shopping experience with a feeling of personalization that is often missing from frustrating jaunts to the crowded mall.

Today, these appointments are moving online and taking new forms. Using technology, the cost of providing personal recommendations to each customer has decreased. In a 15-minute online video call with Everbody, I received a list of recommended cosmetic treatments, products, and general skincare tips. While I probably won’t get Botox anytime soon (the Zoom beauty filter works well enough for now), the appointment did increase my affinity for the company. The key was focusing on informational elements, like skincare and maintenance, versus pushing a sale.

Curated is a startup focused on providing expertise to inform high-ticket purchases, including golf and cycling equipment. It will be interesting to follow this approach—expertise via unbiased experts—in contrast to the guidance provided by associates who are clearly interested in selling their brand’s products.

Operationally, virtual consultations and guided shopping appointments are an opportunity for top-performing associates to build out a book of loyal clients that will continue to yield results post-pandemic. As a brand, this is a chance to identify and nurture your most talented associates.

The virtual appointment space is primarily a 1:1 interaction. During the pandemic, we’ve also seen the emergence of social shopping, which serves a similar purpose (curation, education, and discovery) but via a 1:many or few:many structure:

Pilot livestreams and expert-led virtual events

Branding “eCommerce livestreaming” or “the new QVC,” social shopping has been big in China for many years. I’m very curious about how this will evolve in the U.S. as content and commerce become more closely linked. There is a lot to say here so I will save a deeper dive into this topic for a future post.

Virtual events, when conceived with consumers’ needs in mind, can unlock a lot of value. Consumers are spending more than 13 hours each day in front of screens-up 3 hours from Q3 2019, according to Nielsen. These additional 3 hours are a window of opportunity to test creative activations.

Dough, a collective of women-founded brands, hosted What Not To Wear’s Stacy London to showcase her top picks via livestream. Post-event, a items mentioned were highlighted via email and on the Dough site, allowing those who weren’t in the livestream to still access the curated product list. In the B2B space, Faire is launching virtual trade shows to enable small makers to sell to boutiques remotely.

Incentivizing lower-cost fulfillment

While growing transaction size and increasing brand loyalty are important goals, much of the cost of eCommerce operations comes from out-of-control fulfillment and returns costs. There are a lot of ways brands can improve the on-site experience so that customers better understand what they’re buying—better-quality photos, reviews, adding product videos, etc. These are important drivers to reduce returns. I’m also curious about how incentives play into this.

I recently noticed when ordering on Amazon that I was offered the option to opt-in to a slower shipping speed in exchange for an Amazon credit. I’m curious whether other brands can adopt this policy. Slower shipping speeds can result in significant savings for brands. Amazon’s offer is especially elegant because the credit must be used on Amazon, ensuring that they capture future sales in an emergent part of their business (Amazon Prime Video in this case). Other variations could include:

If customer accepts a slower shipping speed, give them a small rebate to donate to a charity of their choice

Issue a rebate back to the customer if they do not return anything after 30 days (goal is to disincentivize ordering of multiple sizes/variations)

Provide education on the environmental impact of shipping and returns (ideally coupled with sustainable packaging); then allow customer to make their own choice

Closing thoughts

This is not an exhaustive list of omnichannel strategies, but rather, one focused on mitigating the key challenges that a major shift toward eCommerce presents: high return rates, costly fulfillment, and lower transaction values. It’s never been a more exciting time to work in retail and consumer—everyday small and large brands are experimenting with all of these strategies. The next phase of the process for many brands is understanding how to stay profitable with these new initiatives in place. I hope this provides some helpful guidance.

Interesting nuggets from around the web

WM-Shopify alliance helps both companies against Amazon / Supreme vs. Madhappy / Shopify pivots to an Integrator / From Assets to Brands *A Must Read* / The future of experiential retail / Loose Threads whitepaper on what’s next for physical retail / Amazon teams up with Valentino to sue alleged counterfeiter / What is good retention?/ Amazon private labels and antitrust

*If you’ve published anything related to the future of commerce, I’d love to help amplify your work. Reply to this email with a link and I’ll try to include it in next week’s newsletter*

✨ Stay Curious,