Hi Friends,

It’s been a couple weeks since I last published—I’ve missed you all! The reason for my slower schedule is that I recently started a new role at Estée Lauder in omnichannel strategy. This is a dream role for me since it’s all about bringing stores into the future and building awesome customer experiences…right up my alley 😊

Today I’m starting to tackle a HUGE topic, the future of brand discovery. I believe the process for “getting to know” new brands is broken. This topic could fill many books, so I’m starting today with a high-level look at the landscape. Over the next few weeks, I’ll be exploring some up-and-coming solutions to the discovery problem.

Photo by Cristofer Jeschke on Unsplash

Back in the mid 2000s when I was a teenager, malls were still a cool place to hang out. I’d meet up with friends at Sbarro for a slice (or California Pizza Kitchen if it was someone’s birthday 🍕) and wander the shops.

When shopping for my prom dress, there were only ~5 stores I considered visiting. Many of these were department stores that carried a multitude of brands. Department stores did the work of curation for me.

This was the era of the traditional brand funnel. Consumers start with a set of potential brands and systematically eliminate options until they make a purchase.

Since then, the process of “discovering” a brand has become much more fragmented. McKinsey defined the Consumer Decision Journey in 2009:

The [traditional brand] funnel concept fails to capture all the touch points and key buying factors resulting from the explosion of product choices and digital channels, coupled with the emergence of an increasingly discerning, well-informed consumer. A more sophisticated approach is required to help marketers navigate this environment, which is less linear and more complicated than the funnel suggests.

In the consumer decision journey, brands can be added and subtracted from the consideration set throughout the decision-making process.

It’s amazing that there are so many brands that want to be the Perfect X for us. There is an olive oil that speaks to my millennial lifestyle, and home goods designed for tiny apartment living (I’m definitely the target customer). But as the number of brands vying for our attention grows, it becomes harder for any one to break through the noise. And it becomes frustrating for customers to navigate brand choice across myriad channels and formats.

When I shop for a formal dress today, my customer journey covers various discovery approaches:

Scroll Instagram explore page and save anything I like (downside: I wade through weight-loss tips and pictures of reality TV stars)

Google style descriptors like to identify relevant brands in Google Shopping (downside: I sift through poor-quality listings that are likely dropshipped from overseas)

Check out new styles from my favorite monobrand sites, e.g. Reformation (downside: I can look at only one brand at a time)

Look at what’s in-stock with my favorite designers on multibrand sites, e.g. Nordstrom and Shopbop (downside: many multibrand sites have poor UX and clunky filtering/search capabilities)

Google a few brands that friends have mentioned to me (downside: hard to remember)

Often, brands I’ve stumbled across and liked early on in my “discovery phase” have been forgotten by later in the process. Many times, I end up settling because I’m simply tired of scrolling.

As a person who studies the “future of retail” I refuse to accept that this is how an ideal shopping experience should look. The good news is that I’m not the only one who sees an opportunity.

Discovery isn’t a problem for all types of goods

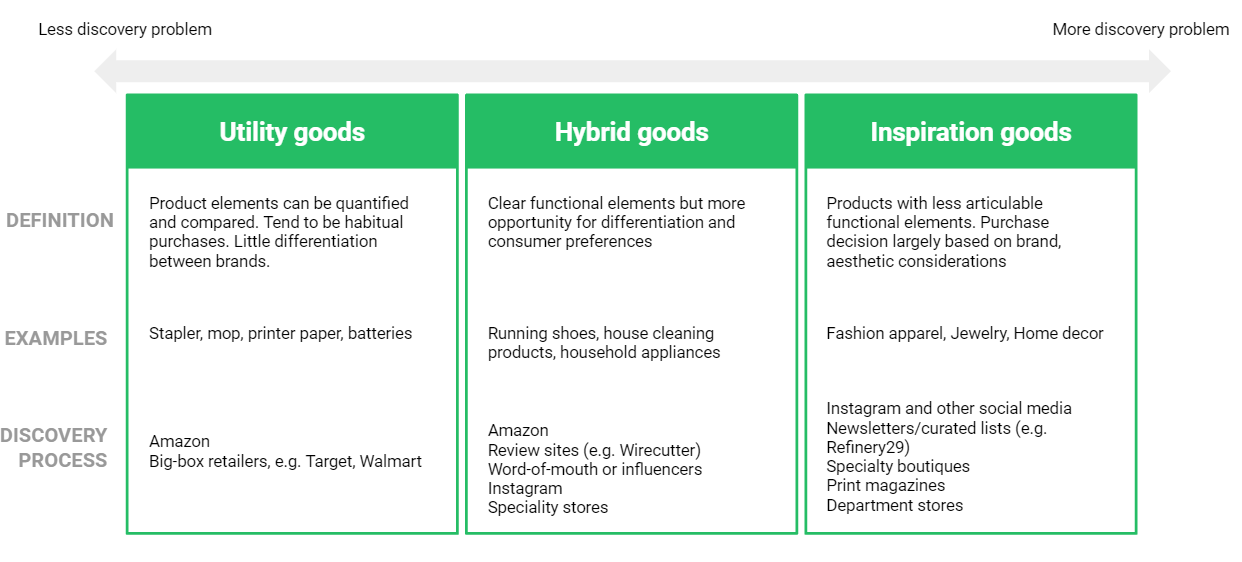

Shopping for a formal dress is time-consuming and often frustrating. But I don’t encounter the same issues when buying dishwasher detergent. When I look at my last few credit card statements, clear segments emerge:

Shopping for utility goods is easy. Technology has added a level of transparency that enables me to quickly find my desired specifications at the best price.

From the brand perspective, it’s terrible to be viewed as a utility good. Even in categories with little differentiation, it’s possible to carve out a branded niche and extract value (generic Amazon Basics mop vs. Swiffer). In this case, they are positioning as a hybrid good.

Amazon is the clear owner of the discovery process for utility goods. 46.7% of product searches start on Amazon. This product comparison table from Amazon highlights all of the main decision factors I need when choosing a mouse. I can look at this and feel I’m making an educated choice. When it comes to utility products, it will be difficult to disrupt Amazon’s grip. This is why many upstart CPG brands are listing on Amazon, or actively considering it.

My discussion of the discovery process will focus on hybrid and inspiration goods. These are products where harder-to-measure decision factors like “fashion sense” play a bigger role.

How did we get here?

Examining the discovery process for hybrid and inspiration goods highlights why discovery today is so challenged. The channels that we used to turn to to discover new brands in these categories have lost their former glory. Going back to my prom dress example, my friends and I searched in department stores and encountered hundreds of brands at Macy’s, Dillards, and Belk. Even pre-pandemic, these retailers were contending with weak mall traffic and declining sales. Now, they are all facing massive layoffs.

Similarly, print media was a valuable tool for brand discovery. I still enjoy reading Vogue, but other shopping-oriented publications I turned to for style guidance, like People StyleWatch and Lucky Magazine are long gone.

Instagram is the inspiration behemoth that replaced much of what department stores and print media offered. It enabled influencers and brands to act as tastemakers, serving as a democratizing force for brands. Pinterest plays a similar role, on a smaller scale.

But these tools are not panaceas. It’s expensive to reach new customers on Instagram (and on other social channels), and the landscape is increasingly noisy. And until recently, there was limited ability to connect inspiration to transaction. Instagram’s roll out of Shopping features for brands is an attempt to rectify this challenge.

We don’t suffer from a dearth of inspiration; rather, we are struggling to seamlessly connect inspiration with commerce.

Who is filling the the inspiration-to-transaction gap?

In short, everyone. Winning even a small piece of this pie is extremely valuable.

What’s more interesting is HOW different players are attacking discovery. Some are starting with a niche audience in mind and curating a selection of products that fit their values (e.g. The Verticale). Others are starting with a large selection of brands and leveraging data to show only a subset to individual consumers (The Yes). Facebook, Google, Snap, Amazon, and Shopify are all working on solutions to empower brands and creators to more easily communicate with and sell to customers.

An initial examination reveals commonalities across this market:

Authenticity is key: Word-of-mouth marketing is the primary driver behind 20-40% of purchasing decisions. Hearing a recommendation from someone you know and trust is much more valuable than reading an anonymous online review. Mavely allows anyone to make money from recommending their favorite brands, making word-of-mouth picks easy to view and shop. Thingtesting is adding transparency to the ratings process for DTC brands. Livestreaming solutions like Supergreat feature shoppable reviews from real users.

Telling a story: Dough curates women-owned brands and builds trust by labeling products that are from Black-owned businesses, products that are made sustainably, and other criteria. Modern department store concepts like b8ta and Neighborhood Goods share the story behind the brands they feature through a mix of online and offline media.

Less is more: I’m hoping that the days of endlessly scrolling through generic product listings are numbered. By presenting fewer, more relevant options, these solutions are focused on reducing the decision burden on customers. Brands must understand how to shine across these platforms so customers can “meet” them throughout their Decision Journey.

I look forward to sharing more about these solutions and how they’re attempting to fix the discovery problem in the coming weeks.

✨If you’re enjoying this newsletter, please consider sharing with a friend or two!✨

📚 Interesting nuggets from around the web

Shopify and the Hard Thing about Easy Things - Not Boring

From one of my favorite newsletters by Packy McCormick. He argues that Shopify is “arming the rebels” a bit too well. By reducing the barriers to entry for eCommerce brands, anyone and everyone can build a store (though this is notably different than building a brand). This makes it harder to capture meaningful value.

Reimagining B2B commerce with Faire - Anu Hariharan and Nic Dardenne

Faire is a B2B marketplace that connects local, independent retailers with brands. In a world where you can order anything online and receive it within two days, independent retailers still travel to multiple trade shows each year, where they make procurement decisions based on gut instinct. Faire has modernized this process, enabling retailers to discover thousands of brands, purchase products online, get free returns on new orders, and finance their working capital. On the other side of the marketplace, Faire enables brands to find new customers, manage their existing customer base, and reduce their risk of non-payment

Faire is a B2B answer to the discovery puzzle I discussed here—they are lowering the barrier for brands to find distribution in new channels

Today, only 4% of B2B sales occur online, with Amazon Business driving at least $10 billion in sales annually. 49% of transactions are still done manually via phone, fax, or in-person meetings with sales representatives and account managers.

The viral loop enables cross-side network effects at scale: As Faire aggregates more demand (retailers) and supply (brands), the marketplace becomes more valuable to both sides.

If Faire can become the single place where brands manage their business, it has the potential to be the largest wholesale aggregator in the world.

A handy visualization of retail bankruptcies - CB Insights

Brands aren’t companies, they’re universes - Christopher Morency

Brands including Nike and Gucci are doubling down on owned channels. The latter generates 85% of sales from owned channels.

Not only does speaking and selling directly to consumers increase margins, give a brand better insights into their clientele, and allow them to better control markdowns — most of all, it allows them to own the touch-points and interaction with its audience from A to Z. Many department stores, popular boutiques, and glossy magazines are already folding as a result…in order to be relevant, third parties need to become cultural producers in their own right. Those who can’t innovate through rich brand-fitting storytelling risk being bypassed by the brands themselves.

Like the secondary sneaker market being a more accurate sign of a sneaker’s success than the primary market, the most successful brands understand that fan accounts are where credibility around a brand is created through opinionated discussion about product, new campaigns, and real people wearing the brands.

Despite brand tribes already growing beyond megafans, the rise of DTC 2.0 will see the scope of what brands address, discuss, and endorse grow as a bid to reach an even larger audience. The long outdated realization that consumers don’t just have one favorite brand will result in businesses broadening their brand universes through the curated endorsement of products, people, and places outside of their owned realms. (see my writing on Why brands should launch marketplaces).

*If you’ve published anything related to the future of commerce, I’d love to amplify your work. Reply to this email with a link and I’ll try to include it in next week’s newsletter*

As always, I love hearing from you so please reach out with any thoughts on this article, past ones, or just to say hi!

Find me on: Twitter | LinkedIn

✨ Stay Curious,