Hi 👋 to the new subscribers that are here with us this week!

My post on the problems with eCommerce seemed to resonate with folks—thanks for the love! It was fun to dive into the research. As I’ve seen new names pop up on my subscriber list, I realized I should reintroduce myself. I started this newsletter because I’m truly a huge nerd about all things consumer and retail, and I’m excited to meet others who feel the same way. I’m so happy to have you here. I endeavor to make this one of the best emails you get each week.

About Melina: I’m a consumer strategist and operator with experience at brands like Pandora Jewelry and Lola. I started my career at McKinsey and gained an appreciation for making business strategy accessible and fun. I started a DTC womenswear brand, Keaton, with the goal of simplifying office dressing for the next generation of professional women. I’m not sure where my company stands in the age of Zoom and WFH, but I’m figuring it out. Getting comfortable with uncertainty is something all of us have been forced to do this year!

Why Curious Commerce?: In my pre-MBA job, I monitored industry trends and reported on them to leadership. I really enjoyed this and wanted to get back to it. I’m also looking for my next full-time opportunity. I admire how my investor friends approach the world from a thesis-driven perspective. I want to take this approach as I go into recruiting. What major forces will shape the future of consumption in the next 5-10+ years? How can I align my career next steps with these macro shifts? This newsletter is helping me structure my thoughts.

Thanks for reading!

Photo by Prudence Earl on Unsplash

I’m really excited to write about resale today (also known as recommerce or the aftermarket) because shopping secondhand has been a part of my life since childhood. Growing up, I bought most of my clothes at Goodwill and Salvation Army. My mom is a DIY extraordinaire. She would spruce up our thrifted finds so I was always one of the “best dressed” at school…on a budget!

It used to be a social liability to wear secondhand clothes. It was something I hid from my peers. Not anymore. As a TA for Penn undergraduates last year, I was heartened to learn that many of my students eschewed fast fashion entirely in favor of secondhand.

The data mirrors my personal experience.

Used is big business

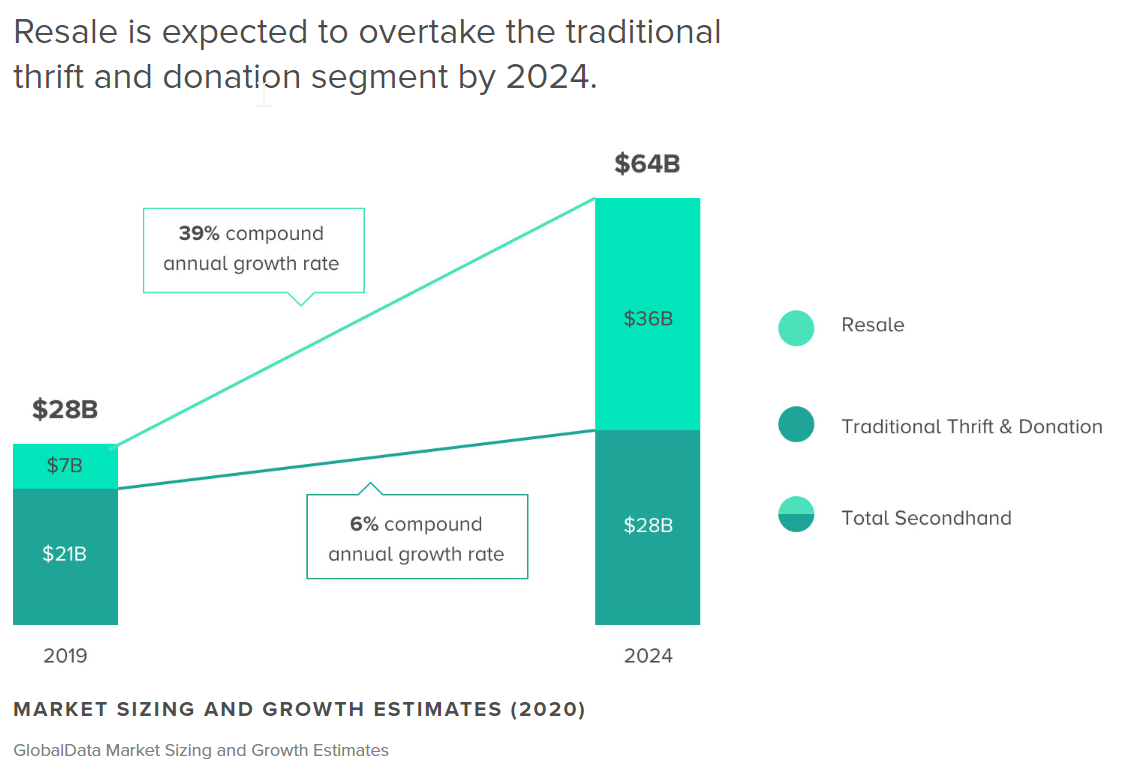

Thredup, a large online resale platform, recently released their annual report on the state of resale. “Resale” refers to the business model of “selling” your clothes into a marketplace or platform, versus donating.

From this research, a few data points highlight how dominant resale is as a category:

Resale is projected to grow at 5x over the next 5 years, while the rest of retail is projected to shrink.

The resale market grew 25 times faster than the overall retail market last year, with an estimated 64 million people buying secondhand products in 2019.

Secondhand goods are expected to make up 17% of a person’s share of closet space by 2029, up from just 3% in 2009. That would put it behind only merchandise bought from off-price outlets such as TJ Maxx, at 19%.

Source: ThredUp Resale Report

Why is resale so popular?

Resale is a two-sided marketplace. There must be demand from buyers for used clothing, and there must be a supply of quality used items. Current market trends support growth on both sides.

Demand side

Sustainability matters: As sustainability becomes an increasingly important part of the dialogue around brand choice, resale is a more attractive option. Resale has been closely linked to sustainability. The RealReal offers a calculator tool to show how consignments and purchases offset environmental impact—more than 80% of RealReal customers say they use the platform for sustainability reasons. 70% of consumers say they prefer sustainable brands. While tying this type of survey data to actual purchase data is fraught with issues, I believe that the desire to be environmentally-aware is a driver of resale’s popularity.

Economic uncertainty: Buying secondhand is less costly than buying new, in many cases. While resale was already booming prior to COVID, the pandemic and resulting economic crisis will only accelerate the shift. During and after the 2008/09 financial crisis, secondhand and thrift shops reported a surge in popularity. Thredup was founded in 2009; the RealReal in 2011—both around the time of the last economic crisis.

Streetwear normalized the high-end secondary market: Streetwear marketplaces like Grailed, Goat, and StockX introduced brand-conscious customers to resale. Consumers learned to trust authentication processes due to scrutiny placed on products in the streetwear market. 28% of streetwear customers say they are most likely to shop at a reseller.

Younger customers feel less stigma around buying used clothes: 80% of Gen-Z customers say there is no stigma around buying used clothes—40% purchased used in 2019. 30% of Millennials and 20% of Gen-X bought secondhand in 2019 as well.

Supply side

Increasing inventory in need of liquidation: Most site visitors to The RealReal or ThredUp probably assume that the items they see previously lived in another person’s closet. In fact, many items belong to a brand’s excess inventory (or returns inventory). Resale marketplaces are used as a liquidation channel for brands. As department store sales have weakened and mall traffic suffers, many brands are stuck with merchandise they can’t sell. Excess inventory was a big problem pre-COVID, it’s an even bigger problem now.

Online resale sites compete with off-price channels like TJ Maxx to sell overstock items. With these stores closed due to the pandemic, more brands than before will turn to online resale channels.

I couldn’t find a source on the share of supply that comes from brands vs. individuals, but my guess is that an increasingly large share is coming from brands. From the perspective of the resale platform, it is cheaper to process large volumes of inventory from a trusted brand compared to one-off items from individuals.

Economic uncertainty: The state of the economy and consumer confidence also plays a role on the supply side. 90% of Gen Z have or are open to selling items in their closet when money gets tight.

Mari Kondo: The viral philosophy of “tidying up” may be partially responsible for the surge in supply at many thrift stores and resale sites. My local donation center had to turn away donations at the height of the craze.

Smaller apartments: As a tiny apartment-dweller in Brooklyn, I’ve suspected that small closets are a contributor to our culture of closet clean-out and resale. Since 2000, the average square footage of newly-built apartments has declined from 993 to 941 square feet (still huge by my standards).

Main players

Within resale, there are Marketplace models (Thredup, The RealReal, Rebag) and Peer-to-peer models (Poshmark, Depop, Vestiaire Collective, Mercari). An emerging third model is a traditional brand that has a resale component, such as Madewell and Eileen Fisher. The specific terms around consignment—timing of when the buyer is paid, commission rates, incentives (store credit vs. cash) etc, vary from company to company.

What the rest of retail can learn

A few buzzwords that I hear often in the retail world are “experiences” and “communities.” Every brand wants to build a community of loyal brand fans and create experiences that “surprise and delight” customers (another cringe-y piece of business lexicon).

The mustiest old thrift store in your hometown has already nailed “experiential” retail. And many of the digitally native resale platforms are excelling at community-building.

Treasure hunt

I like poking around thrift stores because you never know what you’re going to find. An old designer bag? An art deco lamp? Vintage jeans? Customers want to come back often because there’s always something new. This is the secret sauce of “experiential” retail—not free snacks and Instagram walls.

Resale (and off-price) are the fastest-growing retail channels because they surprise us. We are rarely surprised. Many of our choices are guided by algorithms and therefore flow naturally from our past choices. Being in a shopping environment where discovery is very raw and unstructured is unique.

Even on Depop, where there is an feed of featured items, human stylists play a major role in curation. As resale platforms scale maintaining the sense of magic in discovery will be a challenge.

Authentic communities

Communities thrive naturally in the resale world. Especially in peer-to-peer marketplaces, users consistently interact and negotiate. For Depop, there are active Facebook groups and Reddit communities where sellers can share tips and coordinate photo shoots. Depop learned from their super-users that there was a need to professionalize photography, so they opened studio spaces in select cities that sellers can reserve for free.

X factor: Scarcity

An additional success factor for resale is scarcity. Each item is unique. A customer has to buy or they could miss out.

✨If you’re enjoying this newsletter, please consider sharing with a friend or two!✨

🔮 Predictions for the future of resale

More brands will launch owned resale

Some brands are building their own resale operations—this will become more mainstream in the next few years. Consider this: rather than having a Levi’s customer sell her jeans on Poshmark, Levi’s can instead buy them from the customer and resell them, generating an additional stream of revenue. Perhaps Levi’s could pay for the buyback with store credit, leading to a next purchase. They haven’t launched this program yet, but they should! (They do have a denim recycling program).

Resale also signals sustainability credentials and allows a brand to highlight durability and quality. Trove (formerly Yerdle) manages resale operations for brands including Patagonia and Eileen Fisher. They are one to watch in this space.

Bifurcation between “high” and low”

High-end items require professional photography, vetted quality ratings, and authentication. Buyers will want free shipping and returns, white-glove customer experience, and a luxury unboxing experience.

For cheaper items, we will increasingly see a move toward more casual channels, including livestreams, IG, and Depop-style home photography. These sellers will maintain margin by not offering returns and selling items “as-is” without as many details. Popular sellers will team up for in-person pop-up events that are reminiscent of flea markets. You’ll be able to order a Mystery Box of miscellaneous used clothes for a flat fee. For low-price items, the quirky “treasure hunt” feel of Goodwill will remain intact.

Innovations will make inventory processing less costly

When a brand lists a t-shirt for sale online, they take professional photos of it, write a listing, put together sizing information and measurements, create SKU information, log inventory, and post it. From this listing, they can generate hundreds or thousands of sales. In the resale world, every product is an “n” of 1, with unique levels of wear-and-tear, unique measurements, and its own SKU. It can be very costly to properly photograph and list each item, especially when customers expect a lower price compared to a new item. I predict that there will be a lot of innovation and automation in this space as resale grows.

Technology will enable additional storytelling about where your products came from

I was at Brooklyn Flea last summer and met a vendor who had a dress from the 1950s in her collection. It had a broken zipper but fit me perfectly, so she gave it to me for free. I was curious to learn about the woman who originally made this dress so many years ago, and all of the milestones it has seen since. How much value would be added to a product if it could capture and tell these stories? I think it would be such an interesting way to share our rich history, and would add so much cache to a brand.

🔥 If anyone wants to kick this idea around, let me know!

Gifting secondhand items will be normalized

Spend on gifts accounts for more than $130 billion each year, yet gifting secondhand items remains taboo. As the resale market continues to grow, I predict that this will change. Beginning with categories like jewelry, hard home accessories, and handbags, gifting “preloved” items will become more mainstream.

Interesting nuggets from around the web

This week and last, there was much written about the Lulu/Mirror acquisition, tumultuous changings-of-the-guard among female CEOs, and the enduring bad retail environment:

Emily Singer on under-served customer bases / Resurgence of subscription boxes? / The brand strategy of DTC candles / Disease influenced modernist architecture, and this is happening again / Changes happening at The Wing / Tyler Haney back at Outdoor Voices / Neela Montgomery stepping down from CEO role at Crate and Barrel / Macy's Q1 loss approaches $4B / Story founder to leave Macy's / DTC brands struggled with profitability pre-COVID...now what? / What we lose when retail store disappear / What's Lulu going to do with their acquisition of Mirror? / Mirror wanted to be the next iPhone. Now it's selling to Lulu / Lululemon's Mirror acquisition could signal a new era in experiential retail / The Unpaid Labor of Female Founders / Unlucky Charms: The Rise and Fall of Alex and Ani / How eCommerce platform Elliot fell back down to Earth

*If you’ve published anything related to the future of commerce, I’d love to amplify your work. Reply to this email with a link and I’ll try to include it in next week’s newsletter*

✨ Stay Curious,