When shopping online sucks...on purpose

This large retailer's ecommerce experience lags behind peers. Here’s why that could be a smart move.

As a new mom (and generally type A person), I’m obsessed with optimizing every aspect of this new life stage. Groceries are ordered online and delivered. I manage my inventory of diapers, wipes, and formula like one might manage an Amazon warehouse. One website has emerged as the clear laggard in my quest for parenting automation. Can you guess what it is?

Perhaps surprisingly - Costco. With prices clocking in at a mere $0.20/diaper vs. brand name offerings at $0.30+, they are the clear winner from a budget perspective. But they leave a lot to be desired in terms of UI/UX. Their site load times are slow. They lack features like subscribe and save, forcing me to (gasp) go online to order diapers and formula on a recurring basis. A quick search of Reddit indicates that I’m not the only person frustrated with Costco’s online experience. So why haven’t they improved?

Exhibit A. On a basic category page, Costco’s site load times rank poorly on several key metrics:

Exhibit B. Product pages lack functionality like subscribe and save. Product photos show only outside of box - no photos of product itself, indicating limited investment in optimizing for online.

Though I might seem like I’m being a hater, I’m in fact a huge fan of Costco - a member, and a tiny shareholder. I believe Costco’s ecommerce experience is purposeful, and their technology investments make sense for their customer and goals. Let me explain.

Why would Costco benefit from a “bad” e-commerce experience?

Customers love the brand more when they shop in-store

Costco is one of the most loved brands in the world in large part because of their warehouse “treasure hunting” experience. Videos highlighting Costco finds and deals rack up tens of millions of views on Tiktok and other platforms. While it’s great to score a good deal online, finding something cool at Costco on a Saturday morning trip with the family is an adventure. It’s a story you tell your friends. Those are the experiences that drive brand love and loyalty. Costco is aware of the valuable relationships they build with customers and focus heavily on the warehouse experience as a result.

One interesting stat that underscores Costco’s customer loyalty - 90% of members renewed their membership this year, according to their recent Q1 announcement. This is extremely strong retention, especially in a period of broadly challenged consumer sentiment.

In-store shopping can be more profitable

For any retailer, operating ecommerce profitably is a challenge.

On the revenue side, in-store shoppers spend more. According to a report by First Insight, 71% of shoppers spend more in-store than they do online. This matches my experience. In-store, customers are more easily tempted by other items. This effect is magnified at retailers like Costco, which are laid out in an almost maze-like formation to maximize the amount of cool stuff the customer will see. You’ll notice that many of the most popular items, including grocery staples, are at the far back of the store, ensuring that to reach them, you’ll need to walk by the jewelry, clothes, and other “fun” categories (these also tend to be the higher-margin categories). Costco’s ideal customer is someone who will walk all around the store, buying across multiple categories - and perhaps stopping for lunch in the cafeteria, too.

In contrast, the online shopper might make a single unit transaction to reorder a product they need right now, then remember tomorrow they need something else and place a second order. Now, Costco is forced to fulfill two orders, the collective value of which is less than that shopper would have bought on a single visit in-store.

Costs of warehousing, shipping, and returns can eat up a large share of ecommerce margin. In contrast, Costco is a retailer optimized for large-scale physical retail. Costco’s warehouse operating model is designed for profitability with palletized inventory requiring minimal handling, reducing the time and labor required to get from manufacturer to the sales floor. Their warehouses tend to be minimally built out and away from the highest-cost retail centers. While I’m sure the costs to run a massive warehouse are astounding, this model is their core competency. Ecommerce is an entirely different business model that is likely less profitable for them right now.

For a great breakdown of Costco’s business model and keys to operating their warehouse model, check out this clear explainer.

It’s not a priority

According to their year-end report from 2023, e-commerce sales made up just 6% of Costco’s revenue. Among Costco’s list of priorities, the online experience probably falls pretty low.

Ultimately, the website is functional and takes orders. Customers love Costco because they get a good price. Investing in lots of sleek new features may not be a priority.

The counterargument: The case for more ecommerce investment

Invest for growth

While ecommerce may make up a small percent of Costco’s revenue today, that share is growing. In the company’s most recent Q1 earnings, they announced 13% growth of the online channel, vs. 5% for warehouse.

Increased investment in the ecommerce experience and the Costco app could catalyze growth further.

Shore up against competition

Costco’s competitors include Amazon and Walmart (and their wholesale club, Sam’s) both of which have invested heavily in their ecommerce and online fulfillment experiences over the past decade.

In their most recent quarter, Walmart Inc. (which includes Sam’s Club) saw ecommerce growth skyrocket more than 20% year-over-year for the third straight quarter, a growth rate 5x faster than overall growth. Some of this strength was attributed to ecommerce investments in areas like curbside pickup and to online order fulfillment from stores, which can speed up delivery times.

While Costco’s online growth is impressive, these numbers from Walmart are even more so. It could indicate that some consumers are choosing where to shop based on what online features are available - for a busy parent, the ability to do curbside pickup is a big convenience.

Unlock new revenue - customers far from a warehouse

On average, an ecommerce customer for Costco probably isn’t as profitable as a warehouse customer. But what if that ecommerce customer wouldn’t otherwise shop at Costco at all? Costco may want to snag her spend, instead of seeing this customer shop a competitor.

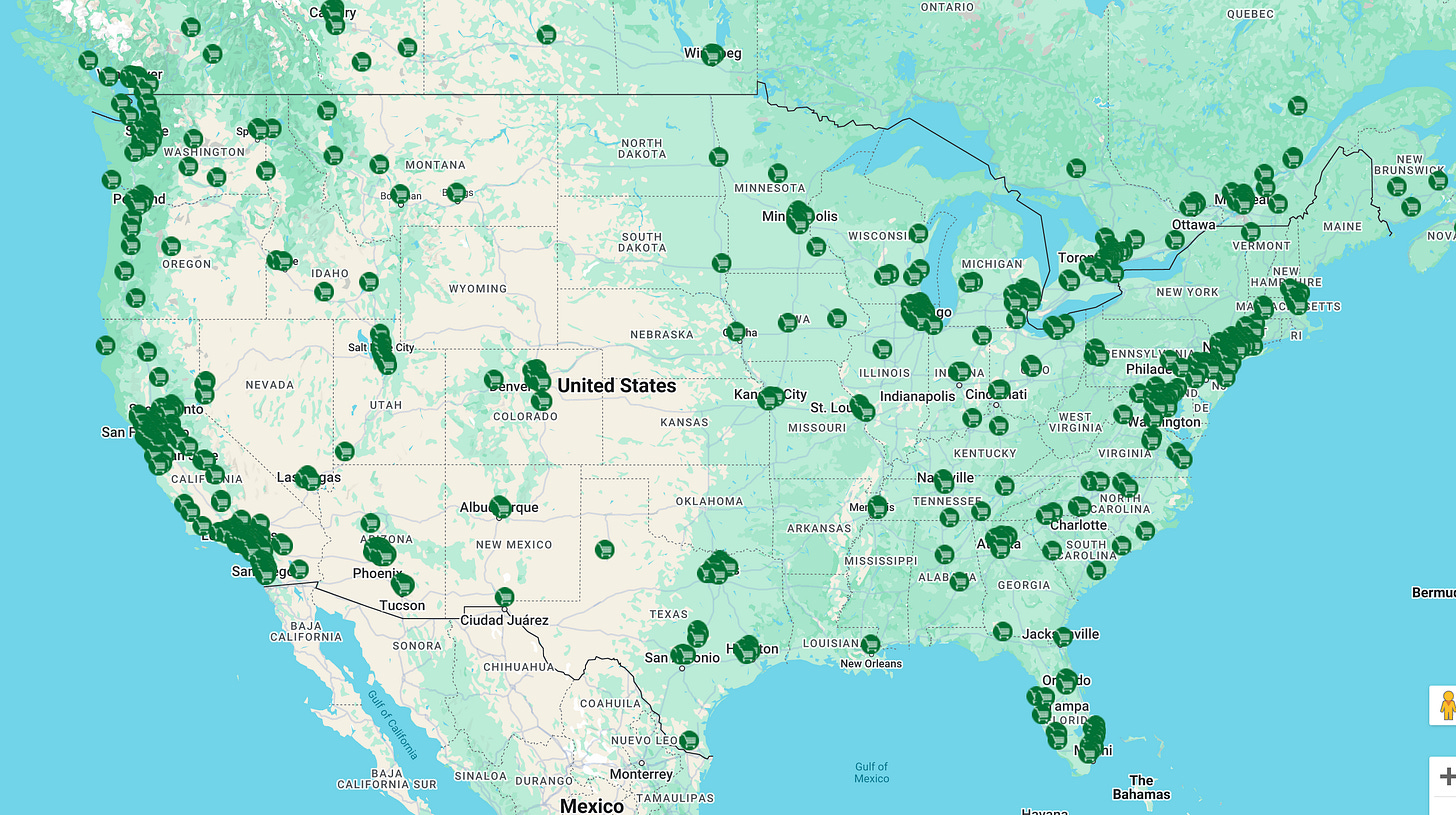

While Costco operates over 800 warehouses today and has coverages of most major metro areas in the U.S., there are plenty of areas where consumers aren’t easily served by a warehouse. As a New Yorker, I’m one of these shoppers. While there is technically a Costco warehouse in south Brooklyn, it’s a 45 minute drive away from me. However, I love my membership and enjoy shopping online. If I ever move closer to a warehouse, I already have a membership and have loyalty to the brand. Continuing to bolster the online experience makes sense for a growing retailer looking to further expand their membership base.

Data & Insights Opportunities

Costco offers ~4,000 SKUs in their warehouses and roughly 9-11,000 online (2023 annual report). Via their online business, they have access to tons of data on how products are selling, and which specific geographies are driving those sales. This enables them to make smarter buying decisions for their warehouses. This is but one example of how Costco can use data captured from the online shopper to inform their broader business.

My take: Costco’s recent technology investments show us they are prioritizing omnichannel aspects of the online experience

Costco’s recent annual reports and public statements suggest that a digital transformation is underway to address some of these pain points. Costco is making some interesting technology investments that link online and warehouses. They are clearly prioritizing their warehouse shopper, while setting the stage for online modernization.

A recent(ish) addition to Costco’s site is the ability to see what inventory is available at one’s local warehouse. This capability is typically the first step to unlocking more complex functionalities like curbside pickup or Buy Online, Pickup In Store. I believe we will see these launch soon for most products. These capabilities are heavily requested by customers and offered by most competitors.

Another investment highlighted recently was the implementation of membership card scanners in-store to speed up checkout. The focus on in-store technology underscores the priority of the warehouse business.

I suspect that over the next few quarters, we will see an increasing focus on site modernization with an emphasis on features - like curbside and BOPIS - that support an omnichannel shopper, and those - like search, navigation, and perhaps personalized upsell/cross-sell - that drive higher online basket values and work to mimic the in-store browsing experience.

What I’m Curious About this Week

- ’s breakdown of Perplexity’s new ecommerce tool - I will be trying this out and sharing more. I think there’s a huge opportunity to improve how we search. Perplexity’s approach of integrating with Shopify so transactions can be completed through Perplexity itself is a big step from previous AI-enabled search tools, which might make good recommendations but can’t always drive conversion to purchase directly.

- ’s piece on how gift guides drive value for publishers - from affiliate revenue to building cultural relevance, it seems like every creator, brand, and publisher is publishing a gift guide this year.

I love nothing more than an end-of-the-year trend recap, and

is the best. I’m loving her take on 2024 Internet Trends.

ICYMI

Last week I wrote about the changing role of the retail store and shared a bit about me and why I’m writing Curious Commerce. Check it out!

The changing role of retail stores & more!

For this week’s issue, I’m changing things up a bit and sharing a grab bag of some fun commerce tidbits that have caught my eye, and then a re-introduction to me and Curious Commerce.

Stay Curious, Melina

Such great insights. I've always wondered the same thing about Costco's online experience vs. in-store.

so much good stuff in here- love the idea that Costco is playing into the "treasure hunt" idea. thanks for the mention!!