😺 Consumer goes niche

DTC platforms like arfa, Pattern Brands, Brandable, and Very Great are looking to be the next-gen P&G...with some key differences

Hi Friends,

Thank you for tuning in for this week’s edition of Curious Commerce. I’m so happy to have you here! I’m Melina. I work as a strategist for retail and consumer businesses, and have my own womenswear brand, Keaton.

Curious Commerce is my weekly attempt to decode the future of commerce, inspired by other disciplines and my own experiences. If you enjoyed this article, be sure to subscribe for weekly reflections on the future of consumer and retail!

A few weeks ago, I shared my take on what’s next for the DTC space. I argue that in order to preserve the benefits of the DTC model (ownership of consumer data, responsive operations, laser-focus on customer experience) and mitigate the challenges (hyper-competitive landscape, rising acquisition costs, lack of scale), new models are emerging:

Quick time out.

Why am I interested in getting technical about new DTC business models?

When the early DTC brands emerged, they made us feel savvy and cool for discovering them. We were excited to tell our friends about Glossier or Warby. Now that feeling has worn off for most brands. Some select brands might still have it, but it’s very challenging to hold on to as a brand grows. I want to tell my friends about Psychic Outlaw, a brand that makes one-of-a-kind chore coats from vintage quilts. But I don’t want to share yet another eco-friendly waterbottle in exchange for 20% off.

These new DTC models are interesting because I believe they will enable founders and creators to go back to building really cool products that people love. “House of brands” models de-risk smaller TAM businesses. I hope these new models will usher in solutions that solve problems for groups beyond the coastal elite. As I share below, I think there is some evidence that this is already happening.

Different starting points, same destination

Many businesses play across several of the six models listed above. For example, Brooklinen started as a standalone brand making high-quality linens. Now, it hosts a marketplace on its site (Spaces). Verishop, an online marketplace created to enable the discovery of digitally-native brands, has launched a skincare brand of its own, Ghost Democracy (also a great name for a band). P&G has an innovation incubator (M13) but also acquires DTC brands (Billie). We are in a transitional phase of the DTC lifecycle where companies with resources and brand equity are looking to capitalize on their advantage by growing both horizontally and vertically.

The future is niche

On Modern Retail’s podcast, Pattern Brands CEO Nick Ling discussed the idea that due to saturation in the market, new brands will be capped in terms of size. He believes brands will need to form increasingly personalized relationships with customers in order to thrive within their well-defined niches. I fully agree with this analysis. In the world of DTC holding companies, many niche brands can drive more sales than one brand designed to appeal to a wider audience.

The pressure to “grow at all costs” fueled by VC funding shielded many in the industry from the obvious conclusion that there is an upper limit on the number of people who will have an affinity for a certain aesthetic within a category. Rather than pay ever more to acquire a less-enthusiastic incremental customer, Pattern is homing in on a specific customer (an urban-dwelling millennial) and building a suite of complementary products that help her enjoy life.

The flip side of this approach is employed by arfa. Arfa launched their first product, Hiki, in March. Arfa is unique because it allocates 5% of profits to The Collective, a group of people who inform product development from ideation through launch. On their site, they elaborate on the thesis for why niche is necessary:

Consumer product good companies have spent the last hundred years refining systems to maximize profits. Production, distribution and research have all been ‘optimized’ to an amazing level of detail.

The end result is a drug store aisle full of nearly identical things, 75% of which are produced by the same company, and are aimed at the same ‘average consumer’.

arfa wants to hit the reset button. To re-imagine our industry, and to create personal care products that serve not the ‘average consumer,’ but actual people with unique bodies, and individual wants and needs to care for them.

Rather than targeting the same customer with their portfolio brands (like Pattern), they are focused instead on identifying pockets of need first, using The Collective as a guide. They can leverage a common playbook and organizational structure to efficiently fill gaps that traditional CPGs may have viewed as “not worth their time.”

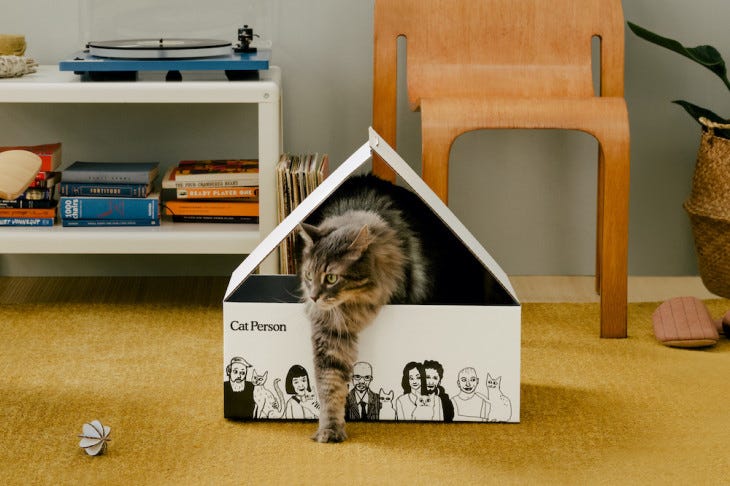

Cat Person launched recently as a brand for cat owners, a stealth venture out of Harry’s Labs. Cat owners are by no means a small market, but I wonder whether a brand focused only on this market would have been able to pull off such a seemingly well-funded launch on its own. Perhaps it would have been launched instead as a brand for all pets, losing some of its personality in an effort to appeal to more customers. Under the umbrella of a corporate parent, a smaller TAM is less of a liability.

All about distribution

One of the biggest challenges for any founder is building a distribution engine for their product. For clean beauty brand Briogeo, it was pitching Sephora at a trade show. For the founder of Schmidt’s Naturals, the process included leaving comment cards at retailers. Spanx founder Sara Blakely famously asked her friends to go into early Spanx retailers to request the products. These make for great chapters in a founder’s memoirs, but what if we could skip the pain and jump right to making sales?

That’s the goal behind distribution-focused holding companies like Iris Nova and Brandable. Iris Nova is the parent company behind cult beverage company Dirty Lemon. Their goal is to “remake the soft drink aisle” by providing a platform to promising beverage brands that are healthier than status quo brands, while making a profit. Not only does Iris Nova offer a native text-to-order platform for all of its third-party brand partners, it also works to secure placements for its brands via wholesale relationships. Iris Nova is also experimenting with owned retail—it has one location, called The Drug Store.

Brandable calls itself a “CPG Platform” and is the parent company of brands like Queen V and Craft City. The common thread between these brands? Killer relationships with retailers like Walmart and Target.

“What we are aiming to do is to become the next multibillion-dollar CPG company. We want to be the P&G of the future,” says Christian Patino Webb, 36, who became executive vice president of Brandable in July last year after holding marketing and brand management positions at P&G, Johnson & Johnson and Red Bull. “Our vision is to build the most innovative brands on the market by doing two things: helping consumers live their best lives and igniting pop culture.”

They break down their strategy for launching a new brand here:

Brand cultivation at Brandable is a three-step process. For the first few months of a brand’s life, Patino Webb says the company relies on tactics that require low investment but net high return on investment such as influencer marketing, press outreach and sampling. In the second stage, Brandable increases its investment in influencer marketing, press outreach and sampling, and amplifies digital advertising. In the third stage, national media campaigns are executed. Queen V is entering the third stage. It’s going beyond Walmart to several big retailers this year.

While different business models employ different playbooks, the ability to test and iterate across multiple brands in quick succession provides a chance to continuously improve.

Organized to scale

In the book The Upstarts, Brad Stone attributes some of Uber’s success in scaling fast across diverse geographies to its rigorous use of a flexible playbook. I remember thinking: why can’t someone apply approach this to DTC businesses? As a first-time founder, I am constantly making decisions with little applicable data. I can ask for help from advisers and experienced founders, but often there is no alternative but to “learn by doing.” In contrast, when I was in the corporate world, I could see historical data on years’ worth of previous interventions to make an informed recommendation.

Consumer goods platform Very Great emerged after founders Josh Williams and Eric Prum experienced similar frustrations launching and scaling design brand W&P over several years. They decided that they could streamline what worked from W&P’s early years, discard what didn’t, and apply the model it to other consumer brands. The result? Pet lifestyle brand Wild One and stylish electronics brand Courant, so far.

Looking at these businesses from the outside-in (otherwise known as LinkedIn stalking), it seems that most of the DTC platforms are employing some version of a matrix model, where Brands are headed by Owners that have a lean team working for them. The brands leverage a shared architecture of support functions including marketing, finance, sourcing, sales, etc. This allows best practices to be shared directly across brands. Today, many of these platforms have only 1-3 total brands in-market. It will be interesting to see how these organizations evolve as more brands are launched and some start to meaningfully break away from the pack.

P.S.

There are many more companies in this space with unique specializations. Beach House Group creates influencer-driven brands. Innovation Department builds brands designed to thrive on Amazon. Thirty Madison has built a suite of customer-facing healthcare solutions. A-Frame Brands launches personal care products specifically made with hemp. I’m sure there are many others that I’ve neglected to mention.By design, many of these parent companies are nearly invisible from the customer perspective.

If you’ve enjoyed this newsletter so far, please consider sharing with a friend or two:

What I’m Reading

📚 That Will Never Work: The Birth of Netflix and the Amazing Life of an Idea - Marc Randolph. The Netflix story is so fascinating—this is a great story about the earliest days of the company from the founding CEO. *Support your local indie and shop with my Bookshop links*

📰 Can Multilevel Marketing Companies Like Beauty Counter and Sseko Ever Be Ethical? - Alden Wicker. MLMs are fascinating (read: shady AF) and this is a very nuanced examination into whether some may be doing some good—for women and the planet.

📰 AI Programs Are Creating Fashion Designs and Raising Questions about Who (or What) is An Inventor - The Fashion Law. When a robot designs your clothes, who gets the credit? The answer is pretty complicated.

📰 Animal Crossing is the Only Place We Get Dressed Up for Now - Veronique Hyland. Sandy Liang and Marc Jacobs are the latest designers to collab with Animal Crossing. Finally—apparel that’s zero marginal cost and fully universal. I’ll have to update my takes from last week.

✨ Stay Curious,

Melina